By Michael Gardon of The Simple Dollar

So, you’re are ready to start building up a savings plan. Congrats. Most people don’t have any real plan when it comes to saving money. As a former professional trader, tne of the biggest questions I get asked by friends, family, and readers is “what is the best way to start saving and investing my money?†Like all habit change, saving and investing isn’t just a thing you do, its a mindset. To get that mindset right we have to tap into the same universal principles that work for any other habit change. Fortunately, in the world of finance, there is no shortage of technology that can help us nail down our savings plan by making it simple, easy and effortless.

My goal here is to briefly present a few of the traps that often grab our attention, create anxiety and cause us to take wrong actions. Then I’ll get you immediately up and running on a simple savings automation plan designed to get you piling up cash without even thinking about it. This is how I’ve approached automating my savings and investing plan to minimize distraction and keep my focused on my saving goals.

Saving Money Traps: The Psychology Behind Bad Choices

I want to cover here what often derails us from making the best choices regarding our savings. Each one of these mentalities is dangerous in its own way.

- My number is too small so its not even worth starting. Half of the U.S. is not equipped to handle a $400 emergency. If you saved $1 a day for a year, you’d almost be better off than half of the country. NO number is ever too small to start.

- Interest rates are too low, so why save. Cash is king! Even if it’s not earning anything, it gives you many more options which have value. You could pay cash for a car and save 3.5% on your auto loan for instance – a better rate than if it stayed in savings! Or, you might

- I have to learn how to pick stocks so I can make some real money! If you can’t dedicate a significant amount of time to research, this is a lost cause. You’re better off using low-cost index funds and saving your time.

- I need to make money fast so, I’ll put all my cash in the stock market and sell in 6 months. This is gambling. You might get away with it, but it won’t work in the long run. What happens if you lose your money? You’re worse off in a big way.

- Watching our account balances go up and down every day. Actively trying to manager your stock and bond portfolio is a recipe for a panic attack. You will undoubtedly want to sell when the market is going down, and buy when it’s going up.You might be invested in stocks or bonds for the next 30 years, who cares about a couple days?

The Simple, Effortless Savings Automation Plan

The traps outlined above are just a handful of examples of the psychological difficulties surrounding making, keeping and investing your hard earned money. Tuning out the noize is the key to steady, happy returns. I’ve worked very hard in the last couple of years to automate my savings and investment program to avoid them and minimize the anxiety that comes from constantly monitoring my investments. While this is an activity that requires much attention, it is also an activity that can suck you in and cause undue anxiety.

Here are the steps

- Get a savings account

- Understand why you are saving, and create buckets for saving

- Understand your time frame and risk tolerance

- Find the appropriate accounts that match your buckets, time frame and risk tolerance

- Automate

Get a Savings Account!

My first recommendation is to get a straight up savings account that has good online features – direct deposit and the ability to transfer to outside accounts at no cost. You really don’t have to know anything else to start putting money away. Later you can get the best rate, and start looking at investments.

Why Save?

The once you have an account and are putting a little money away, the next step is to be at peace with why you are saving. We save for two primary reasons: risk mitigation – basically the ability to weather an unforeseen financial setback, and freedom – the options a big pile of cash gives us later in life to retire, move to the south of France, give to charity or create a new life for ourselves.

There are definitely more specific reasons why you might be saving that you could list as specific goals like “retirement,†“new car,†or “emergency fundâ€. Understanding your why and time frame for goal for each goal is critical to choosing what to invest in.

I do this by creating “buckets†that I need to save for, like this:

Risk mitigation:

- I want to create and maintain cash “emergency fund†so that if my family encounters a setback like a prolonged period of unemployment, I know I have enough cash to stay afloat. Time Frame: short

- I want to have enough cash to continue paying my insurance premiums such as life and disability because those policies mitigate risk in other areas of my life. Time Frame: short

Freedom savings:

- I want to maximize my retirement contributions so I can hopefully retire early. Time Frame: long

- I want to save for my children’s educations. Time Frame: long

- I want to hold extra cash on top of emergency fund for alternative investments as those opportunities present themselves. Time Frame: short

My savings goals are ambitious and comprehensive, but even if your goal is to start an emergency fund of $500, it is important to really get in sync with your why, as this helps you prioritize and allocate your money.

Time Frame

Your time frame dictates what accounts, tools and investment vehicles we should use to accomplish our savings goals. You can save money in anything, a bank account, stock trading account or under your mattress. The proper means depends on your goals and their time frames.

Short term needs

A typical definition of “short term†is anything less than one year, and you would put any money that you would conceivably need within a year into the safest possible account you can find.

I personally define short term as anything less than 5 years – this is very conservative, but I’ve been around long enough to see risky assets plunge when people needed access to their money.

Short term money should be kept in non-risky accounts – like a savings account. So, if I envision needing a certain bucket of money within 5 years it is in a savings account. This includes:

- emergency fund

- any savings for an upcoming purchase, like a car or vacation

- extra alternative investment cash (such as for a real estate investment)

I use a large, national bank with access to online banking, direct deposit and automatic transfers to manage my short term cash, more on that later.

Long term needs

Long term savings may be used for retirement, college education, home purchase or simply anything else. Because these things have a longer time horizon, you generally have more options for investing in riskier assets like stocks and bonds. These assets tend to get you a better return on your money, although that is not guaranteed, and you can actually lose money, so they are not for everyone.

Risk vs. Reward Investments

Its very important to understand that generally higher reward, in terms of investment return, also comes with higher risk of loss. This is a fundamental concept that essentially explains why you earn 0.06% (national average) on your insured savings account, 2.5% on a longer term bond and maybe 7% average or higher on stocks (over the long term). Each step up implies higher risk with stocks being the highest risk (of the three options here).

How you react to the risk vs. reward concept is highly individual and is called your risk tolerance. Just because everyone else might have 100% of their money in stocks doesn’t mean you should. The goal of a savings plan is peace of mind, not to create more anxiety. If you’re more comfortable with all of your money sitting in a savings account, then that’s what you should do, but understand, and be ok with, earning a smaller return over your investing lifetime. Believe me, I traded stocks for a living in my 20’s and there is nothing more nerve wracking than watching your hard earned money go up and down constantly.

Most financial professionals would gauge your risk tolerance by asking a few questions like:

- what is your age?

- what is your investing experience?

- if your investments lost 20% would you sell everything, stay the course or buy more?

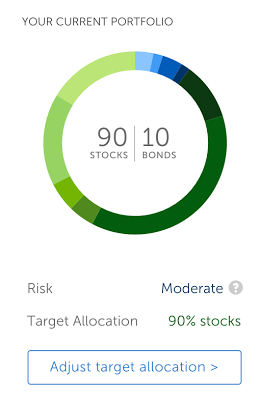

In a long term savings plan your risk tolerance and time frame are used to set your basic allocation to stock, bonds and cash. Here is an example from my own personal long term account:

This reflects a relatively high risk tolerance and long time horizon until I would use my investment dollars in retirement (I’m currently 34 years old).

Choosing the Right Type of Account for your Savings Buckets

Once you are familiar with the concepts above, you can start researching the right accounts for your more advanced buckets. I have many different financial accounts, but they basically break down into the following categories:

- checking – for all my day to day transactions

- savings – for short term emergencies

- Retirement – IRAs, 401(k)s, etc

- brokerage – for some limited short term stock and option trades I do from my history of trading the markets.

The Simple Dollar has plenty of resources on these different types of accounts, and there are many more fine resources throughout the internet.

Automatic Savings Program

Here is exactly how I automate my entire savings plan.

Expense Tracking and Budgeting

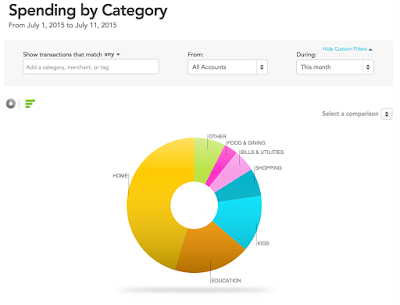

I use Mint.com to track all of my assets, debts, spending, net worth and budget. I use a credit card for every transaction I can so that my expenses are digitized and can be imported. Credit cards aren’t for everyone, so you can accomplish the same thing with your debit card transactions. You can also use paper receipts and a spreadsheet, but I find software easier. Mint allows me to understand and adjust my budget to get a handle on how much I can save and put away. Here is what the spending analysis looks like.

This tool is how I figured out how much I can save each month in order to set up automatic savings transfers within my accounts.

Paycheck Direct Deposits

My paycheck comes in on the 1st and the 15th of every month. I have my pay net of taxes deposited into my checking account. I also have my maximum allowable tax deductible retirement contribution directly deposited into my 401k. This happens immediately, so I never see these funds and want to spend them. This technique is called “pay yourself first†since you are banking money right away that you will keep.

I use a large, national bank with great online banking features and local branches although I’d consider going all online since I rarely walk into a branch.

Automatic Transfers from Checking to All of My Buckets

Once money has made it to my checking account, I have automatic recurring transfers set up to all my other accounts. This happens within a day of the paycheck hitting my account. Here is the percentage breakdown based on my buckets:

- Emergency fund – 10% (already heavily funded)

- Extra investment fund – 45% (currently TD online bank)

- Extra retirement – 25% (currently at Betterment using low cost index investing)

- Kid 1 college – 10% (regular savings)

- Kid 2 college – 10% (regular savings)

Automatic Payments of All Bills

The other area that often creates anxiety for people is paying bills. I use the same approach to automate all of my monthly bills that are recurring. I either set up direct transfers for things like credit card bills (to ensure I pay the full amount on time each month), OR I use my bank’s online bill pay feature. This way, I’m truly confident that 95% of my finances are taken care of without worry.

The Monthly Review

With all of the details, worry, and anxiety taken out of my plan by automation, I’ve freed up a ton of time that I can spend with my kids, and I’m much better focused with work and social activities. I really only spend about 30 minutes per month reviewing everything. This is made very possible again by Mint. I can log in, review all my spending transactions, compare month to month spending, savings and account balances. Most importantly, I can see my net worth climb month after month after month – and that’s the true metric of saving success.

Michael Gardon in one of the editors of the excellent personal finance site The Simple Dollar.